The general economic and financial market optimism which sprouted last year carried forth into the first quarter. AI hysteria, with its real promise, and the absence of recession, have both helped to maintain public equity spirits, and prices. Regardless of short run market sentiment, our focus remains on corporate profits. Each quarter, earnings from our portfolio companies almost invariably accrue to us as shareholders. These dollars in turn fund dividends today, and when successfully re-deployed, convert into realized gains tomorrow. Q1-2024 was no exception in this regard.

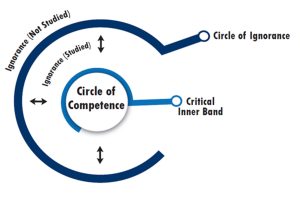

One of ACR’s five core investment principles is to invest only in what we understand. The great irony of accumulating knowledge over the years is the humble admission that the more we know, the less we know. We consider two directly related “circles” as a useful mental model when evaluating companies, industries, and the broader world around us. The first is called the “circle of competence”, originated by Warren Buffett. The second we call our “circle of ignorance”, an additional layer in our mental model for thinking about the principle of understanding.

Our circle of competence consists of companies, industries, and other topics, about which we can make meaningful high probability statements. It is decidedly small. Our circle of ignorance consists of everything we have studied, such as the business, products, and markets for legions of companies, about which we must say, “I don’t know”. “I don’t know” may be the three most important words in investing. Conversely, “we think we know”, when we really don’t, may be the four most dangerous.

The circle of ignorance can be thought of as having an outer and inner band. The outer band contains everything that we have studied, which grows with our ever-expanding learnings. Beyond the outer band lays still more ignorance, but of things we’ve never looked at. The inner band represents the critical line between ignorance and competence. The main goal is not necessarily to expand our circle of competence as much as possible, as one might think. Rather, the key is to make sure that our understanding of each investment is really within our circle of competence. In other words, investors don’t need to know everything about everything. They need to know what they own.

The temptation is to think one’s circle of competence is always expanding as more companies, industries, and developments are studied. Surely, the investor develops new areas of competence and deeper insights over the years. Moreover, the deeper the analytical dive, the more likely we are to properly understand a business. Yet, those very insights go both ways. That is, our circle of competence can shrink as the inner band of ignorance reverts back in. This happens when we learn more about a situation and realize that we don’t really understand it.

Discovering the critical line between “ignorance” and “competence” is probably the most difficult part of investing. The line is rarely clear and requires rigorous intellectual integrity to get right. To claim competence in investing, the determining variables and weightings must ultimately result in a high probability of investment success, which we define as realizing a satisfactory level of future cash flows in relation to the price paid for them. Here we have a loophole. An extraordinarily cheap price can make up for some measure of ignorance. Our circles of competence and ignorance can therefore expand and

contract not only based on what can be known, but on price.

How deep must one dive to achieve competence? Rarely inches, sometimes feet, other times miles. It is not so much how deep the dive but what it takes to understand something well enough. Cutting time cost is important. We want to get to the point, as quickly as possible, where we know enough to know that we can’t know enough, and to move on. A finer point often presents itself when the most knowledgeable people about a company cannot claim competence because uncertainty reigns. Put another way, we must not only outrun the guy next to us, but the bear. We want to be more astute than

our competition, as well as gauge what no one may know.

Smart and curious investors are likely to expand their circle of ignorance at a greater rate than their circle of competence. Widening our circle of ignorance more than our circle of competence may be the single most important process discipline that we have taken to protect from disappointing results. Investing is a humbling business. There are more ways to lose than win, a fact recently reinforced in a paper that we cited in our year-end 2023 commentary.

The overconfidence of investors is nevertheless legion. The investment industry has always reminded us of Lake Wobegon, “where all the women are strong, all the men are good-looking, and all the children are above average.” Daniel Kahneman, pioneer in behavioral finance and 2002 Nobel Laureate, once said: “What would I eliminate if I had a magic wand? Overconfidence.”1 The only group that may be more guilty of overconfidence than investors are CEOs. Yet, as Kahneman points out, there are reasons for this: “Optimism is the engine of capitalism. Overconfidence is a curse. It’s a curse and a blessing. The people who make great things, if you look back, they were overconfident and optimistic — overconfident optimists. They take big risks because they underestimate how big the risks are.”2

We agree, with added distinctions among three groups. As investors, our foremost mandate is to protect capital, so we simply cannot afford to be overconfident. Good value investors, in our opinion, are natural skeptics. Confidence is only warranted when the facts are on our side. The second group, CEOs of quality, cash flowing companies, must also remain intent on rationality and prudence. We don’t want bet-the-ranch, overconfident CEOs. Yet, we also recognize that CEOs deal with greater uncertainties and must sometimes take bigger risks than value investors. The last group includes two related sub-groups: CEOs dealing with extreme uncertainty and startup entrepreneurs. The odds may be against both, but they must still make decisions, and then proceed with confidence. While we don’t invest in either of these sub-groups, we acknowledge and respect the need for action.

Generative AI represents the rare example today of a new technology which may impact practically everything we know, from individual companies, to labor markets, to how we spend our time. AI hype has gripped the markets ever since ChatGPT was released on November 30, 2022. If you love technology, it was one of those moments when you remember where you were. Word had been spreading fast about ChatGPT, and the family was huddled around our kitchen island on the first day of winter break, December 2022. Our first experiment was to have ChatGPT compare and contrast A Christmas Carol with It’s a Wonderful Life in five paragraphs. Voilà! Homework done! It seemed evident that day, the world would never be the same.

It didn’t take long for the following narrative to surface: “Let an ultraintelligent machine be defined as a machine that can far surpass all the intellectual activities of any man however clever. Since the design of machines is one of these intellectual activities, an ultraintelligent machine could design even better machines; there would then unquestionably be an ‘intelligence explosion,’ and the intelligence of man would be left far behind. Thus the first ultraintelligent machine is the last invention that man need ever make, provided that the machine is docile enough to tell us how to keep it under control.”

Irving Good made this statement in 1965, the year yours truly was born. Good was a British mathematician who worked with Alan Turing as a cryptologist and theoretical computer scientist. He also served as consultant to Stanley Kubrick on the 1968 film 2001: A Space Odyssey, in which we are introduced to Hal, a sentient artificial general intelligence computer. The idea of artificial intelligence has been around for a while. It captures the imagination.

The way we are thinking about the prospects for AI today can be characterized by several potential

scenarios:

- Base case: AI is as revolutionary a technology as the Internet.

- Positive tail outcomes:

- Normal positive tail. AI proves to be the most profound technology in our lifetime, providing meaningful productivity gains for all.

- Crazy pink swan. AGI (Artificial General Intelligence) is properly harnessed and ushers in an unparalleled period of human prosperity during our lifetime.

- Negative tail outcomes:

- Normal negative tail. AI proves useful but ultimately fizzles as a transformative technology.

- Crazy black swan. AGI/AI becomes extremely powerful but is not properly harnessed, resulting in a dystopian world controlled by malicious humans and machines.

The crazy pink and black swans are in our mind highly unlikely, but anything of course is possible with enough imagination. Regardless, we believe a strong policy response to protect from AI’s potential harms is absolutely critical as the technology progresses.

The base case is the lens through which we are planning. Regarding how AI is likely to impact our investments, we think first about playing defense. The ACR investment team is alert to disruption in every industry and company we own and review, especially those directly impacted by AI, such as software. As for offense, we are already prudently evaluating real cash flows and factoring tailwind optionality into certain company valuations. Regarding how AI will impact fundamental analysis and

valuation, we believe it will significantly improve bottom-up analytical efficiency. We also suspect that if AI bots can’t yet run companies, they probably can’t value them either, but time will tell. ACR is set to deploy AI tools across the entire company in the second quarter with a program for actively developing AI use cases, augmented by both internal hires and external consultation.

The reality is that we don’t know how AI will impact the world yet. It remains within our circle of ignorance. Not knowing what will happen feels no different today than it did some thirty years ago when the Internet came along. The Internet quickly became an essential tool for researching companies, while our flagship Equity Quality Return strategy had its three best years from 2000-2002, without owning a single Internet stock. Life is full of surprises. As always, we will endeavor to remain within our circle of competence when deciding what to own in the era of AI.

Nick Tompras

April 2024

End Notes:

- Daniel Kahnenann interview in the Guardian by David Shariatmadari, July 18, 2015.

- 71st CFA Institute Annual Conference presentation, as reported in the CFA Institute Enterprising Investor by Paul McCaffrey, June 8, 2018.

IMPORTANT DISCLOSURES

ACR Alpine Capital Research LLC is an SEC-registered investment adviser. For more information, please refer to Form ADV on file with the SEC at www.adviserinfo.sec.gov. Registration with the SEC does not imply any particular level of skill or training.

Unless otherwise noted, all statistics highlighted in this research note are sourced from ACR’s analysis.

It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the examples discussed. You should consider any strategy’s investment objectives, risks, charges, and expenses carefully before you invest. This information should not be used as a general guide to investing or as a source of any specific investment recommendations and makes no implied or expressed recommendations concerning the manner in which an account should or would be handled, as appropriate investment strategies depend upon specific investment guidelines and objectives. This is not an offer to sell or a solicitation to invest.

This information is intended solely to report on investment strategies implemented by Alpine Capital Research (“ACR”). Opinions and estimates offered constitute our judgment as of the date set forth above and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. There are risks associated with purchasing and selling securities and options thereon, including the risk that you could lose money. All material presented is compiled from sources believed to be reliable, but no guarantee is given as to its accuracy.

The investment outlook represents ACR’s views on the economic factors that may affect the global capital markets. There can be no guarantee that these factors will necessarily occur as ACR anticipates, nor that if they do, they will lead to positive performance returns. There can be no assurance that any objective will be achieved.

The Equity Quality Return (EQR) Total Accounts Composite consists of equity portfolios managed for non-wrap fee and wrap fee clients according to the Firm’s published investment policy. The composite investment policy includes the objective of providing satisfactory absolute and relative results in the long run and preserving capital from permanent loss during periods of economic decline. EQR invests only in publicly traded marketable common stocks. Total Return performance includes unrealized gains, realized gains, dividends, interest, and the re-investment of all income. Pure Gross returns are gross of all fees and do not reflect the deduction of transaction costs in wrap portfolios. Pure Gross returns are supplemental information. Net of ACR Fee returns are Pure Gross returns reduced by 1.0% per annum, which is the standard management fee for the Equity Quality Return strategy. Please refer to our full composite performance presentation with disclosures published under the Strategies section of our website at www.acr-invest.com/strategies/eqradvised-sma-composite.

The S&P 500 TR Index is a broad-based stock index that includes dividend reinvestment and has been presented as an indication of domestic stock market performance. It is unmanaged and cannot be purchased by investors. See EQR’s full composite presentation at www.acr-invest.com/strategies/eqr-advised-sma-composite

The general economic and financial market optimism which sprouted last year carried forth into the first quarter. AI hysteria, with its real promise, and the absence of recession, have both helped to maintain public equity spirits, and prices. Regardless of short run market sentiment, our focus remains on corporate profits. Each quarter, earnings from our portfolio companies almost invariably accrue to us as shareholders. These dollars in turn fund dividends today, and when successfully re-deployed, convert into realized gains tomorrow. Q1-2024 was no exception in this regard.

One of ACR’s five core investment principles is to invest only in what we understand. The great irony of accumulating knowledge over the years is the humble admission that the more we know, the less we know. We consider two directly related “circles” as a useful mental model when evaluating companies, industries, and the broader world around us. The first is called the “circle of competence”, originated by Warren Buffett. The second we call our “circle of ignorance”, an additional layer in our mental model for thinking about the principle of understanding.

Our circle of competence consists of companies, industries, and other topics, about which we can make meaningful high probability statements. It is decidedly small. Our circle of ignorance consists of everything we have studied, such as the business, products, and markets for legions of companies, about which we must say, “I don’t know”. “I don’t know” may be the three most important words in investing. Conversely, “we think we know”, when we really don’t, may be the four most dangerous.

The circle of ignorance can be thought of as having an outer and inner band. The outer band contains everything that we have studied, which grows with our ever-expanding learnings. Beyond the outer band lays still more ignorance, but of things we’ve never looked at. The inner band represents the critical line between ignorance and competence. The main goal is not necessarily to expand our circle of competence as much as possible, as one might think. Rather, the key is to make sure that our understanding of each investment is really within our circle of competence. In other words, investors don’t need to know everything about everything. They need to know what they own.

The temptation is to think one’s circle of competence is always expanding as more companies, industries, and developments are studied. Surely, the investor develops new areas of competence and deeper insights over the years. Moreover, the deeper the analytical dive, the more likely we are to properly understand a business. Yet, those very insights go both ways. That is, our circle of competence can shrink as the inner band of ignorance reverts back in. This happens when we learn more about a situation and realize that we don’t really understand it.

Discovering the critical line between “ignorance” and “competence” is probably the most difficult part of investing. The line is rarely clear and requires rigorous intellectual integrity to get right. To claim competence in investing, the determining variables and weightings must ultimately result in a high probability of investment success, which we define as realizing a satisfactory level of future cash flows in relation to the price paid for them. Here we have a loophole. An extraordinarily cheap price can make up for some measure of ignorance. Our circles of competence and ignorance can therefore expand and

contract not only based on what can be known, but on price.

How deep must one dive to achieve competence? Rarely inches, sometimes feet, other times miles. It is not so much how deep the dive but what it takes to understand something well enough. Cutting time cost is important. We want to get to the point, as quickly as possible, where we know enough to know that we can’t know enough, and to move on. A finer point often presents itself when the most knowledgeable people about a company cannot claim competence because uncertainty reigns. Put another way, we must not only outrun the guy next to us, but the bear. We want to be more astute than

our competition, as well as gauge what no one may know.

Smart and curious investors are likely to expand their circle of ignorance at a greater rate than their circle of competence. Widening our circle of ignorance more than our circle of competence may be the single most important process discipline that we have taken to protect from disappointing results. Investing is a humbling business. There are more ways to lose than win, a fact recently reinforced in a paper that we cited in our year-end 2023 commentary.

The overconfidence of investors is nevertheless legion. The investment industry has always reminded us of Lake Wobegon, “where all the women are strong, all the men are good-looking, and all the children are above average.” Daniel Kahneman, pioneer in behavioral finance and 2002 Nobel Laureate, once said: “What would I eliminate if I had a magic wand? Overconfidence.”1 The only group that may be more guilty of overconfidence than investors are CEOs. Yet, as Kahneman points out, there are reasons for this: “Optimism is the engine of capitalism. Overconfidence is a curse. It’s a curse and a blessing. The people who make great things, if you look back, they were overconfident and optimistic — overconfident optimists. They take big risks because they underestimate how big the risks are.”2

We agree, with added distinctions among three groups. As investors, our foremost mandate is to protect capital, so we simply cannot afford to be overconfident. Good value investors, in our opinion, are natural skeptics. Confidence is only warranted when the facts are on our side. The second group, CEOs of quality, cash flowing companies, must also remain intent on rationality and prudence. We don’t want bet-the-ranch, overconfident CEOs. Yet, we also recognize that CEOs deal with greater uncertainties and must sometimes take bigger risks than value investors. The last group includes two related sub-groups: CEOs dealing with extreme uncertainty and startup entrepreneurs. The odds may be against both, but they must still make decisions, and then proceed with confidence. While we don’t invest in either of these sub-groups, we acknowledge and respect the need for action.

Generative AI represents the rare example today of a new technology which may impact practically everything we know, from individual companies, to labor markets, to how we spend our time. AI hype has gripped the markets ever since ChatGPT was released on November 30, 2022. If you love technology, it was one of those moments when you remember where you were. Word had been spreading fast about ChatGPT, and the family was huddled around our kitchen island on the first day of winter break, December 2022. Our first experiment was to have ChatGPT compare and contrast A Christmas Carol with It’s a Wonderful Life in five paragraphs. Voilà! Homework done! It seemed evident that day, the world would never be the same.

It didn’t take long for the following narrative to surface: “Let an ultraintelligent machine be defined as a machine that can far surpass all the intellectual activities of any man however clever. Since the design of machines is one of these intellectual activities, an ultraintelligent machine could design even better machines; there would then unquestionably be an ‘intelligence explosion,’ and the intelligence of man would be left far behind. Thus the first ultraintelligent machine is the last invention that man need ever make, provided that the machine is docile enough to tell us how to keep it under control.”

Irving Good made this statement in 1965, the year yours truly was born. Good was a British mathematician who worked with Alan Turing as a cryptologist and theoretical computer scientist. He also served as consultant to Stanley Kubrick on the 1968 film 2001: A Space Odyssey, in which we are introduced to Hal, a sentient artificial general intelligence computer. The idea of artificial intelligence has been around for a while. It captures the imagination.

The way we are thinking about the prospects for AI today can be characterized by several potential

scenarios:

The crazy pink and black swans are in our mind highly unlikely, but anything of course is possible with enough imagination. Regardless, we believe a strong policy response to protect from AI’s potential harms is absolutely critical as the technology progresses.

The base case is the lens through which we are planning. Regarding how AI is likely to impact our investments, we think first about playing defense. The ACR investment team is alert to disruption in every industry and company we own and review, especially those directly impacted by AI, such as software. As for offense, we are already prudently evaluating real cash flows and factoring tailwind optionality into certain company valuations. Regarding how AI will impact fundamental analysis and

valuation, we believe it will significantly improve bottom-up analytical efficiency. We also suspect that if AI bots can’t yet run companies, they probably can’t value them either, but time will tell. ACR is set to deploy AI tools across the entire company in the second quarter with a program for actively developing AI use cases, augmented by both internal hires and external consultation.

The reality is that we don’t know how AI will impact the world yet. It remains within our circle of ignorance. Not knowing what will happen feels no different today than it did some thirty years ago when the Internet came along. The Internet quickly became an essential tool for researching companies, while our flagship Equity Quality Return strategy had its three best years from 2000-2002, without owning a single Internet stock. Life is full of surprises. As always, we will endeavor to remain within our circle of competence when deciding what to own in the era of AI.

Nick Tompras

April 2024

End Notes:

IMPORTANT DISCLOSURES

ACR Alpine Capital Research LLC is an SEC-registered investment adviser. For more information, please refer to Form ADV on file with the SEC at www.adviserinfo.sec.gov. Registration with the SEC does not imply any particular level of skill or training.

Unless otherwise noted, all statistics highlighted in this research note are sourced from ACR’s analysis.

It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the examples discussed. You should consider any strategy’s investment objectives, risks, charges, and expenses carefully before you invest. This information should not be used as a general guide to investing or as a source of any specific investment recommendations and makes no implied or expressed recommendations concerning the manner in which an account should or would be handled, as appropriate investment strategies depend upon specific investment guidelines and objectives. This is not an offer to sell or a solicitation to invest.

This information is intended solely to report on investment strategies implemented by Alpine Capital Research (“ACR”). Opinions and estimates offered constitute our judgment as of the date set forth above and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. There are risks associated with purchasing and selling securities and options thereon, including the risk that you could lose money. All material presented is compiled from sources believed to be reliable, but no guarantee is given as to its accuracy.

The investment outlook represents ACR’s views on the economic factors that may affect the global capital markets. There can be no guarantee that these factors will necessarily occur as ACR anticipates, nor that if they do, they will lead to positive performance returns. There can be no assurance that any objective will be achieved.

The Equity Quality Return (EQR) Total Accounts Composite consists of equity portfolios managed for non-wrap fee and wrap fee clients according to the Firm’s published investment policy. The composite investment policy includes the objective of providing satisfactory absolute and relative results in the long run and preserving capital from permanent loss during periods of economic decline. EQR invests only in publicly traded marketable common stocks. Total Return performance includes unrealized gains, realized gains, dividends, interest, and the re-investment of all income. Pure Gross returns are gross of all fees and do not reflect the deduction of transaction costs in wrap portfolios. Pure Gross returns are supplemental information. Net of ACR Fee returns are Pure Gross returns reduced by 1.0% per annum, which is the standard management fee for the Equity Quality Return strategy. Please refer to our full composite performance presentation with disclosures published under the Strategies section of our website at www.acr-invest.com/strategies/eqradvised-sma-composite.

The S&P 500 TR Index is a broad-based stock index that includes dividend reinvestment and has been presented as an indication of domestic stock market performance. It is unmanaged and cannot be purchased by investors. See EQR’s full composite presentation at www.acr-invest.com/strategies/eqr-advised-sma-composite

More Posts

Estate Planning: Beyond the Will

Mr. Market, Riding High – Q4 2024

Secular Bulls and Bears – Q3 2024

Own or Rent? Important Considerations to Review before Purchasing a Vacation Property